JAY SETUPS

Video walkthrough

Video 1

Video 2

Basics

Before being able to start trading Jay's levels, a basic understanding of the CFB bot is needed. These documentation sections should help any new user to grasp a basic understanding of the CFB bot:

Trading Strategy

A basic understanding of technical analysis is strongly recommended to be able to setup and manage trades with or without the CFB bot. There is not a single unique way to use the CFB with Jay's levels. Therefore the purpose of this guideline is to help any trader find their sweet spot, letting them narrow down their own system for level to level trading with the CFB.

Level to level trading is one of the most successful trading techniques. Frequent technical analysis is needed to establish what are called areas of confluence or interest. Many of these areas often offers high probability trade setups with medium to high risk reward ratios.

TA Resources

Different TA sources are available to help traders on a daily basis to update and compare with their own TA:

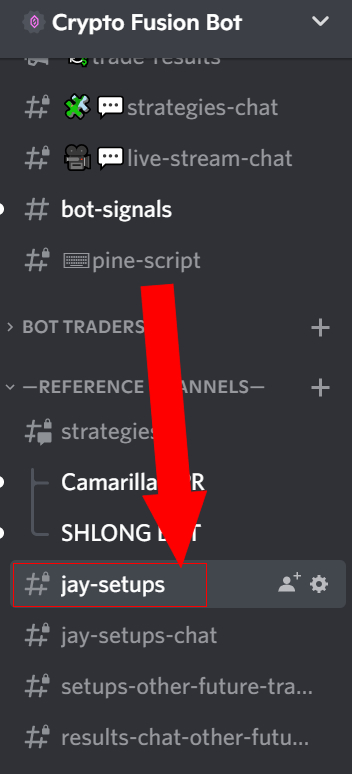

- CFB Discord “Jay-setups” channel

- Jay's public Youtube channel

- Jay's VIP discord live streams

- Jay's Discord TA channels:

potential-btc-day-and-scalp-setupspotential-btc-swing-setupspotential-eth-scalp-setupspotential-eth-swing-setupsvip-alt-ta-jayson-casper

Trade Configuration

The Crypto Fusion Bot allow traders to automatize trading setups in advance with pre-configured settings. Entry price, leverage, stop loss and take profit levels as well as confirmations to increase the level of confluence, are some of the available features. The main aim of the bot is to help traders avoid the need of being in front of the charts to take their desired trades, as well as avoid letting emotions affect decision making when entering and managing trades.

Step by step setup:

-

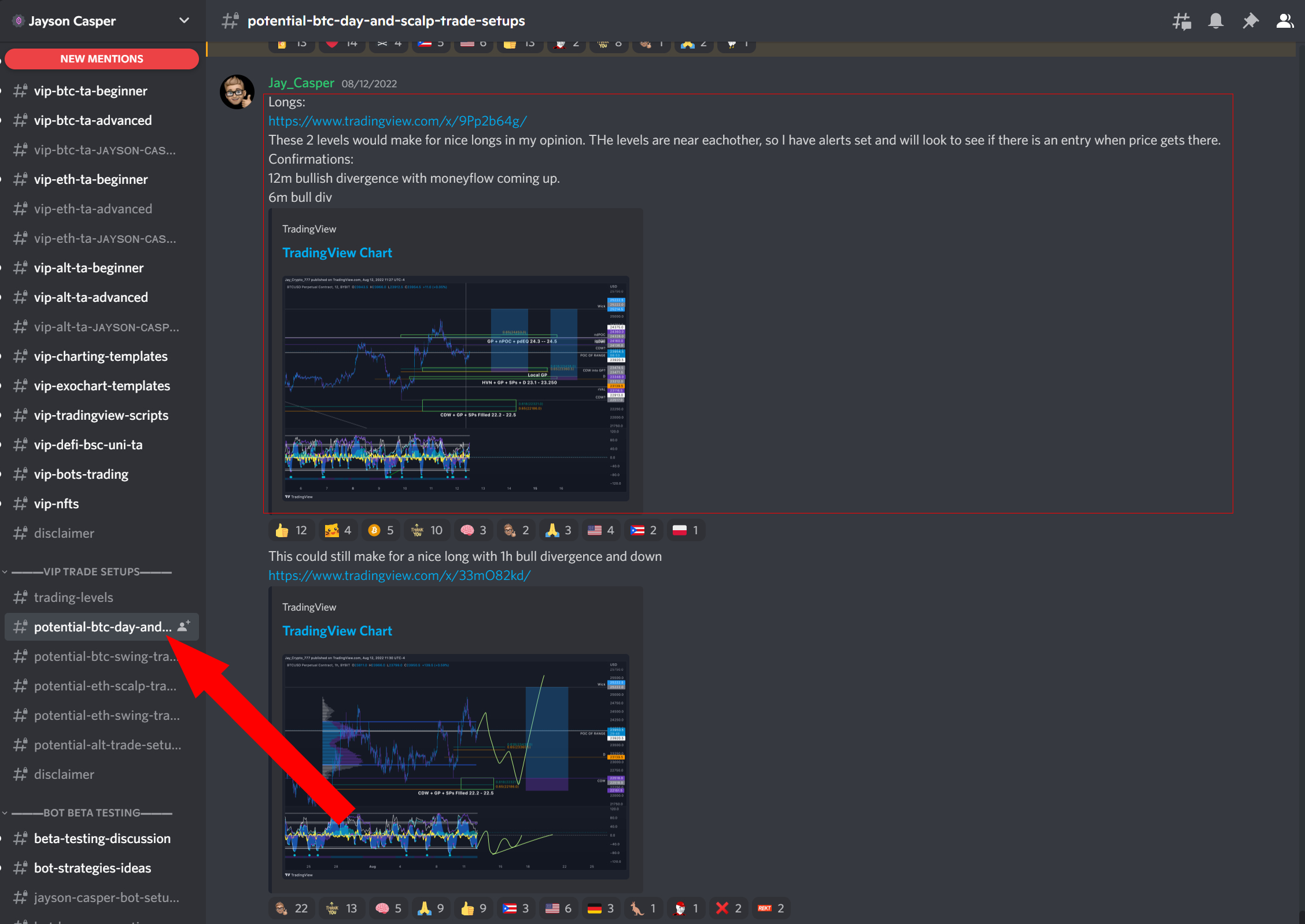

Identify a level with a high level of confluence that can offer a high probability trade. In the TA Resources section multiple sources are available. For this example a trade from the “potential-btc-day-and-scalp-setups” Discord channel is used:

-

To build your trading signal and configure your alert at the desired level, follow the steps outlined in the Future Trades section. In this specific case we could be interested in longing the first long trade in the left side at 23474 level (CDW into GP?).

Note that usually the confirmations that are desirable to be present at the moment of taking the trade, are posted along with the trade setup and chart screenshot. Therefore these can be used to setup the confirmations in the trade signal when configuring your “Future Trade”.

For this specific case the desired confirmations are:

- 12m Bullish Momentum, and 12 minutes Moneyflow coming up.

- 6m bulllish Momentum.

The resultant "Future Trade" script or “Webhook message” to attach to your TradinView alert would look something like this:

{ "symbol": "BTCUSDT", "side": "buy", "entryOrderType": "limit", "leverage": 20, "takeProfits": [ { "percentToSell": 30, "skipStopLossMove": false, "price": 23920 }, { "price": 24290, "percentAboveOrBelowMarketPrice": 0, "skipStopLossMove": false, "percentToSell": 45 }, { "price": 25190, "percentAboveOrBelowMarketPrice": 0, "skipStopLossMove": false, "percentToSell": 25 } ], "notifyDiscordChannel": false, "minimumValue": 0, "minimumAvailableBalancePercent": 0, "extraStopLossMovePercent": 0, "label": "Jay CDW Level Long Trade from 23474", "marketStopLossPercent": 1, "requiredIndicators": [ { "name": "12M_BULLISH_MOMENTUM", "value": "TRUE" }, { "name": "6M_BULLISH_MOMENTUM", "value": "TRUE" }, { "name": "12M_$$$_FLOW", "value": "UP" } ], "balancePercent": 1, "entryOrderTimeoutSeconds": 900, "retryCount": 6, "retryDelay": 30 }

Best Practices

Best Practices to configure Jay's levels potential trade setups:

-

Sometimes the confirmations are not there when the price action hits a level, or the SL is hit after placing a trade. None of these situations necessarily invalidates a level. Because of this reason, there are different valid approaches to manage trades when the desired confirmations are not present:

-

Setup the alert settings to “only once”, and use the retry function to increase your chances to enter into a trade. More retries and more delay between them increases risk. Take into account that once the alert is fired, it will be reactivated if the line where the alert is configured, is moved around.

-

Setup the alert to “once per bar close”. It could be useful when prices ranges around a level before it end up rejecting it, and printing the desired confirmations. In this case, trades require increased monitoring to avoid ending up with multiple trades from the same level.

-

When using the option 1 above, if a trade is not placed because confirmations are not met when the price action triggers the alert, while there is still confidence of a future reaction from that level, the alert can be reactivated.

-

A combination of all the above options.

-

When a wide range of levels of confluence is available, laddering into the trade, increase the probabilities to enter into the desired position, as well as potentially lower the average entry price.

This technique also helps to get into trades using limit orders instead of market orders, which the associated reduce in fees.

Monitoring the stop loss and adjusting it might be necessary to don't get stopped out. While laddering in, careful risk management is specially advised.

-

Once the trade setups are configured, these can stay valid until the price action and/or levels of confluence doesn't change significantly. Or in other words, if there is still confidence that the level of confluence can offer a high probability trade, and the price action didn't hit the level yet, the trade setups can still be considered valid.

-

When configuring take profits and stop losses, support or resistance levels are used. Alternatively the recommended ones if these are posted in the different Discord TA channels can be followed.

-

Before entering a trade is desirable that the price action shows signs of moving into the direction of the trade. Therefore configuring the Tradingview alerts on a certain level to get triggered when crossing down for shorts and crossing up for longs, can increase the probabilities of a successful trade.

-

Normally for Jay's strategy Momentum and MoneyFlow divergences are used to add confluence to a level. When attempting to trade scalps, day or swing trades, different confirmations on different time frames are advised to be used and adjusted based on how much level of risk, and stop loss percentage is tolerated. In other words, and as an example, a swing trade can be initiated by a scalp trade on a CDW trade setup, or by entering when higher time frames confirmations are present. In this last case, once entered into the trade, price action might move in the opposite direction of your trade before moving into the desired direction.

Examples

For examples of Jay's trade setups visit the “jay-setups” Discord channel: