CONFIRMATIONS

The confirmations system consists of active data being fed to the CFB database through the use of TradingView. This is achieved by using the TradingView alert system to send constant updates on different parameters such as Momentum, Money Flow, VWAP, Moving Averages, RSI, and many more. When configuring a trade on the portal these “Confirmations” can be added to any trade for the bot to check them before trades are actually executed in the trading exchange platform.

The confirmations option can be used when configuring a trade to add one or more confirmations or confluences.

All added confirmations need to be met for the trade to be executed.

There are two types of confirmations:

SYSTEM CONFIRMATIONS

The CFB has a number of built-in confirmations which can be used out of the box as an added layer of confluence to any trade. The list of the system confirmations are:

Bullish and Bearish Momentum

This confirmation checks the Borfswitch B (modified MarketCipher B) momentum waves direction. It could be useful to add confluence at a support or resistance level before entering a trade.

- To determine bullish momentum direction for long trades, the momentum waves needs to be trending up. To determine this, the indicator looks back within 50 Bars to find the lowest point in the momentum waves, and compare it with the current candle. If the current blue wave is above the +10 line it is no longer considered bullish. Green triangles are printed in the top part of the indicator when bullish momentum is detected.

- To determine bearish momentum direction for short trades, the momentum waves needs to be trending down. To determine this, the indicator looks back within 50 Bars to find the highest point in the momentum waves, and compare it with the current candle. If the current blue wave is below the -10 line it is no longer considered bearish. Red triangles are printed in the top part of the indicator when bullish momentum is detected.

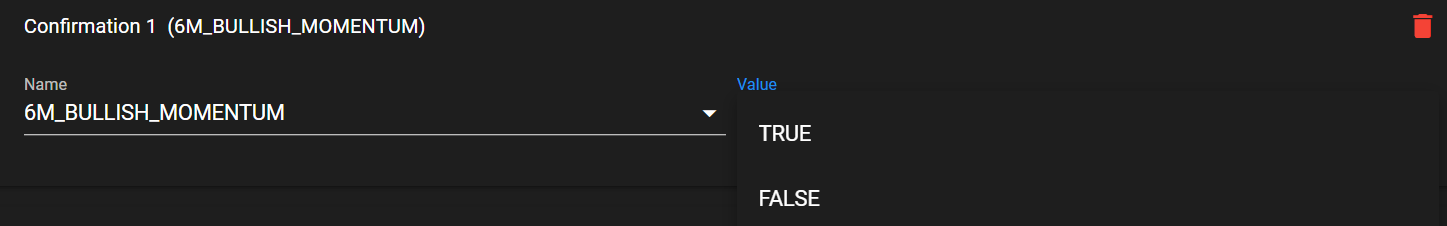

The available confirmations and time frames are:

- 1M_BULLISH_MOMENTUM or 1M_BEARISH_MOMENTUM

- 3M_BULLISH_MOMENTUM or 3M_BEARISH_MOMENTUM

- 6M_BULLISH_MOMENTUM or 6M_BEARISH_MOMENTUM

- 12M_BULLISH_MOMENTUM or 12M_BEARISH_MOMENTUM

- 24M_BULLISH_MOMENTUM or 24M_BEARISH_MOMENTUM

- 1H_BULLISH_MOMENTUM or 1H_BEARISH_MOMENTUM

- 4H_BULLISH_MOMENTUM or 4H_BEARISH_MOMENTUM

The available values are:

- TRUE - When used it will consider that the confirmation is met only if there is bullish/bearish momentum in the selected time frame.

- FALSE - When used it will consider that the confirmation is met only if there is no bullish/bearish momentum in the selected time frame.

Confirmation logic explanatory video:

Money Flow Direction

This confirmation checks the Market Cipher B Money Flow direction. It does this by comparing the current candle to the 5th candle previous. It does not matter what values are present for candles 2 to 4. It could be useful to add confluence at a support or resistance level before entering a trade.

Ex: Current candle (-3) 5th candle back (1)= UP

Ex: Current candle (-3) 5th candle back (-4)= DOWN

- To determine if the Money Flow direction is UP, it compares the current candle position to the 5th candle previous:

- To determine if the Money Flow direction is DOWN, it compares the current candle position to the 5th candle previous:

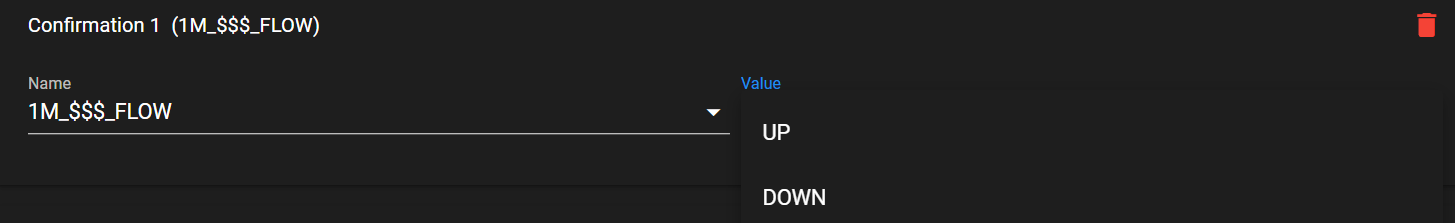

The available confirmations and time frames are:

- 1M_$$$_FLOW

- 3M_$$$_FLOW

- 6M_$$$_FLOW

- 12M_$$$_FLOW

- 24M_$$$_FLOW

- 1H_$$$_FLOW

- 4H_$$$_FLOW

The available values are:

- UP - When used it will consider that the confirmation is met only if the Money Flow is trending up in the selected time frame.

- DOWN - When used it will consider that the confirmation is met only if the Money Flow is trending down in the selected time frame.

Confirmation logic explanatory video:

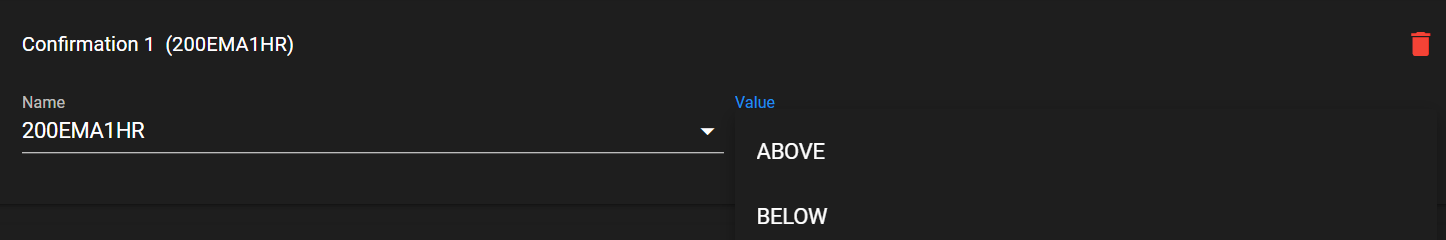

200EMA1HR

This confirmation checks whether the price action is above or below the 200 Exponential Moving Average in the 1 hour time frame.

It could be helpful to determine the market trend to eventually favor long or short trades. When the price action is trading above the 200EMA1HR you might want to favor longs and vice versa when the price action is trading below the 200EMA1HR.

- Do determine when to favor shorts, the price needs to be trading below the 200EMA in the 1 hour time grame:

- Do determine when to favor shorts, the price needs to be trading below the 200EMA in the 1 hour time frame:

The available confirmations and time frames are:

- 200EMA1HR

The available values are:

- ABOVE - When used it will consider that the confirmation is met only if the price action is trading above the 200 EMA in the 1 hour time frame.

- BELOW - When used it will consider that the confirmation is met only if the price action is trading below the 200 EMA in the 1 hour time frame.

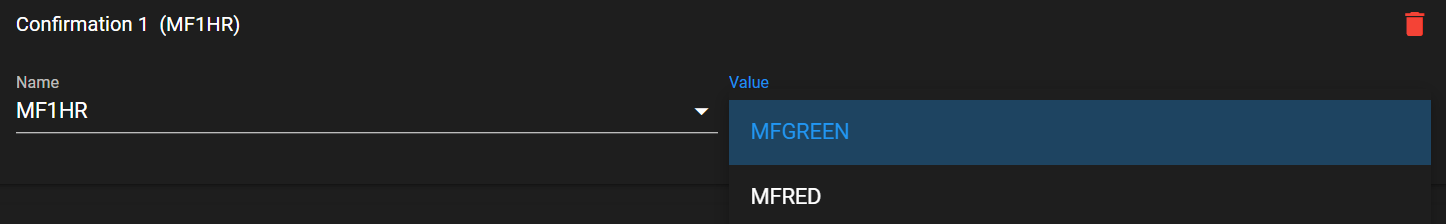

MF1HR

This confirmation checks whether the Market Cipher Money Flow is in green or in red in the 1 hour time frame.

It could be helpful to determine the market trend to eventually favor long or short trades. When the Money Flow is green, long trades might be more convenient, and vice versa when the Money Flow is red.

The Money Flow is printed in green when it is above the zero line, and is printed in green when it is below the zero line:

The available confirmations and time frames are:

- MF1HR

The available values are:

- GREEN - When used it will consider that the confirmation is met only if the Market Cipher Money Flow is in green in the 1 hour time frame.

- RED - When used it will consider that the confirmation is met only if the Market Cipher Money Flow is in red in the 1 hour time frame.

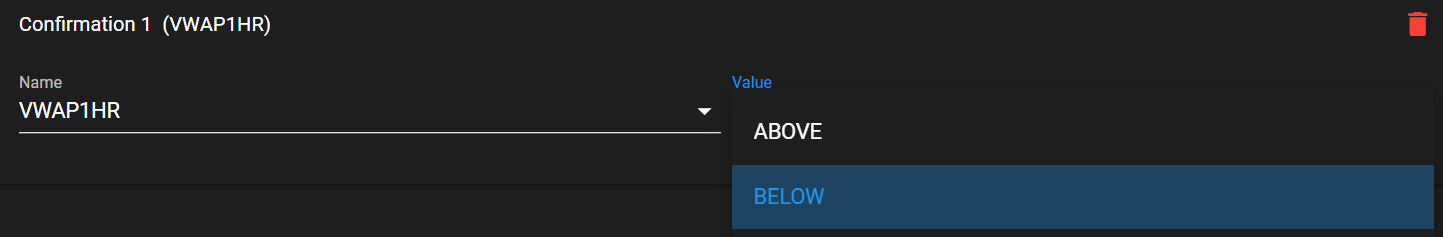

VWAP1HR

This confirmation checks whether the Market Cipher VWAP is above or below the zero line.

It could be helpful to determine the market trend to eventually favor long or short trades. When the VWAP is above the zero line, you might want to favor longs and vice versa when the VWAP is below the zero line.

The available confirmations and time frames are:

- VWAP1HR

The available values are:

- ABOVE - When used it will consider that the confirmation is met only if the Market Cipher VWAP is above the zero line.

- BELOW - When used it will consider that the confirmation is met only if the Market Cipher VWAP is below the zero line.

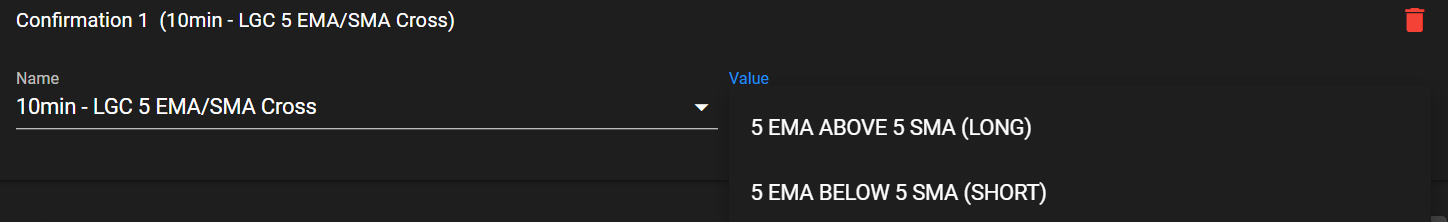

LGC 5 EMA/SMA CROSS

This confirmation of the community member "Looking Glass Crypto" checks if the 5 Exponential moving average - (EMA) is above or below the 5 Simple moving average (SMA).

Long trades should only be taken when the 5EMA is above the 5SMA, and vice versa short trades should only be taken when the 5EMA is below the 5SMA.

The available confirmations and time frames are:

- 1min - LGC 5EMA/SMA Cross

- 10min - LGC 5EMA/SMA Cross

- 90min - LGC 5EMA/SMA Cross

The available values are:

- 5 EMA ABOVE 5 SMA (LONG) - When used it will consider that the confirmation is met only if the 5 EMA is above the 5 SMA.

- 5 EMA BELOW 5 SMA (SHORT) - When used it will consider that the confirmation is met only if the 5 EMA is below the 5 SMA.

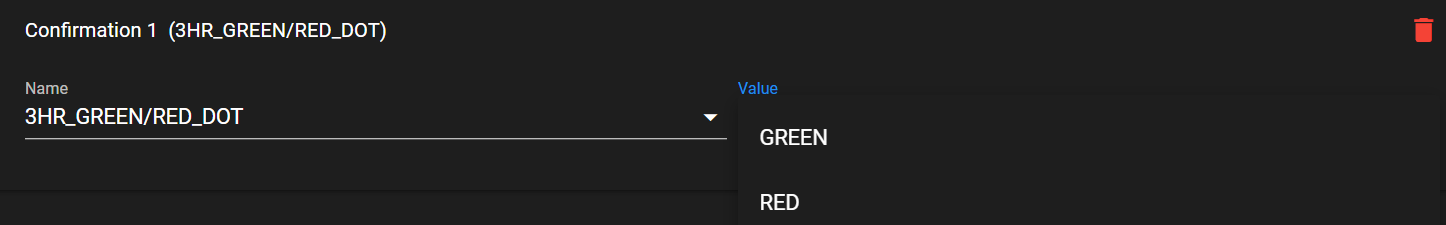

3HR_GREEN/RED_DOT

This confirmation checks if a Market Cipher B Green or Red dot is printed in the 3 hour time frame.

It could be helpful to favor long trades when a green dot is printed and vice versa when a red dot is printed.

The available confirmations and time frames are:

- 3HR_GREEN/RED_DOT

The available values are:

- GREEN - When used it will consider that the confirmation is met when a green dot is printed in Market Cipher B.

- RED - When used it will consider that the confirmation is met when a red dot is printed in Market Cipher B.

CUSTOM CONFIRMATIONS

One of the most potent CFB bot functionalities is the capacity of creating custom confirmations. It allows the use of any sort of TradingView indicator signals in multiple different time frames for added confluence in trading strategies.

The functionality is available by default, and it has a limit of 25 custom confirmations per account.

Video Walkthrough

Step by step setup

-

Decide what TradingView indicator will be used as a confirmation in the trades. For example prior to taking a trade it could be desirable that the CFB bot checks if the price action is above or below the 200 EMA on the 1 hour time frame:

-

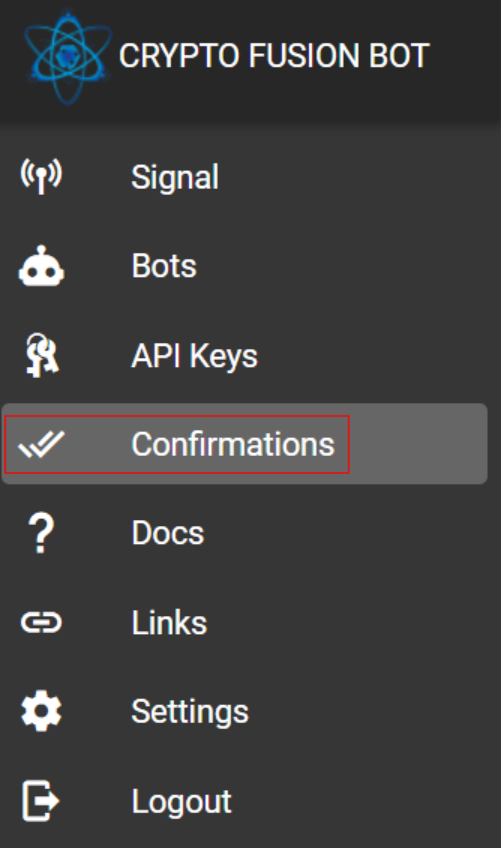

Navigate to the "Confirmations" section in the top left side menu:

-

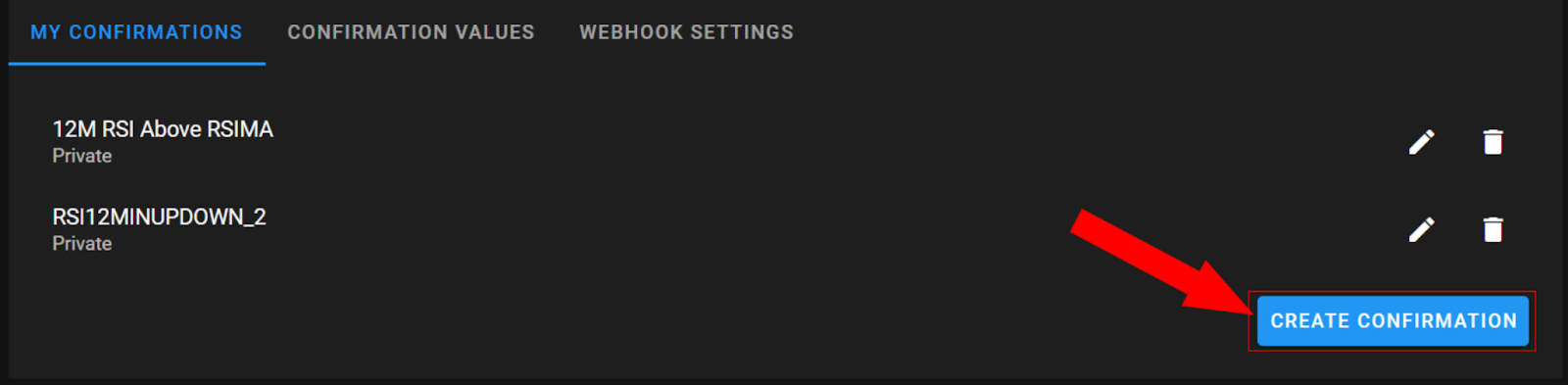

Inside the "My confirmations" subsection press the "Create confirmation" button located at the bottom side:

-

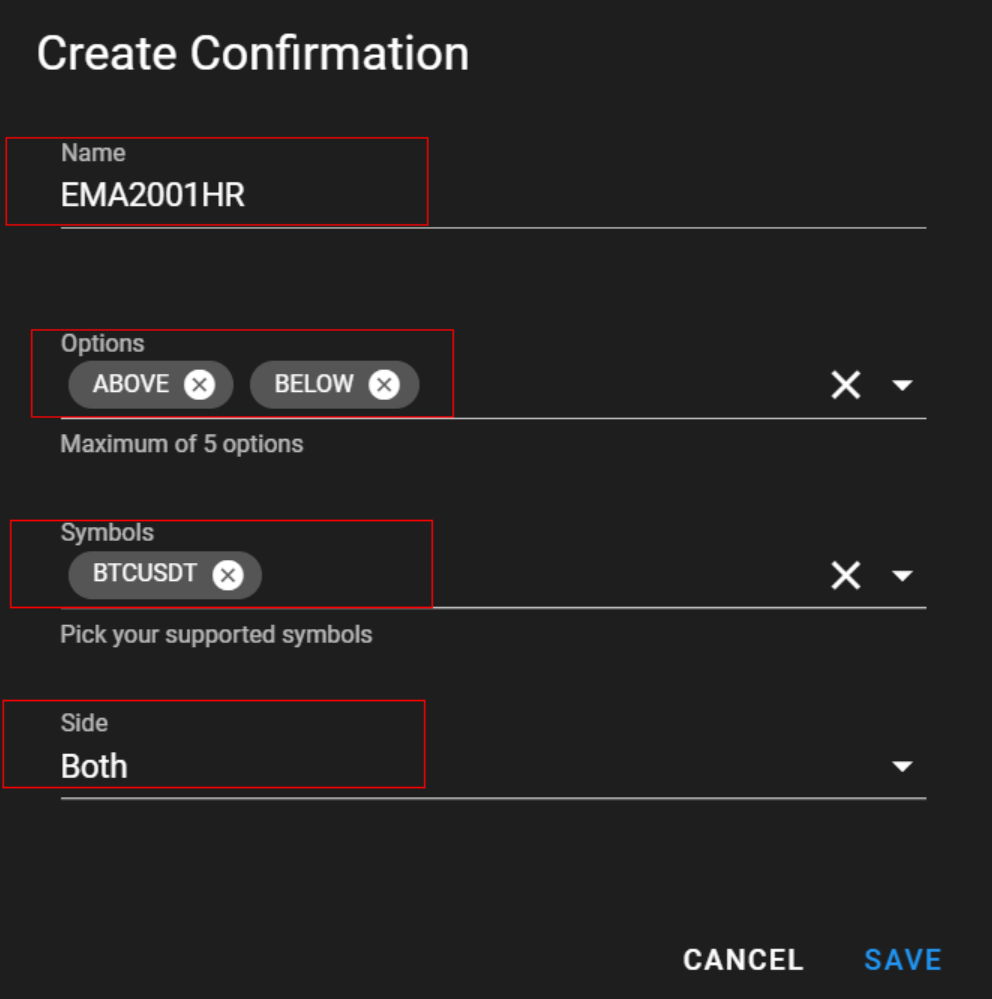

To configure the custom confirmation complete the following parameters (all fields are required):

- Name - Give a distinctive name to the new custom indicator. For example "EMA2001HR".

- Options - Type in up to 5 options. For example "ABOVE" and "BELOW".

- Symbols - Select all the trading pairs where the custom confirmation will be used. For example "BTCUSDT".

- Side - Select if the custom confirmation should be taken into account for long, short or both types of trades.

-

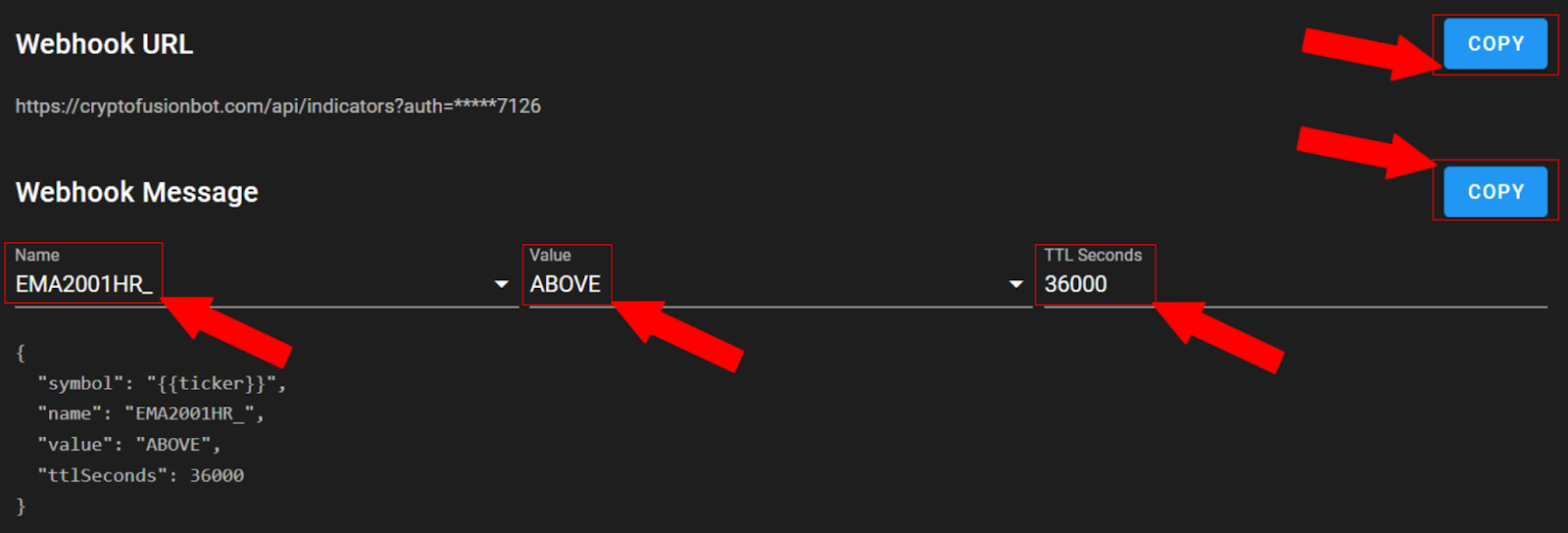

Once the confirmation settings are completed, inside the "Signal" section navigate to the "Webhook Settings" subsection located in the upper part side menu. In this section the "Webhook URL" and "Webhook Message" data is printed which will be used to set up the TradingView alert:

Under the "Webhook message" is obligatory to configure the 3 available settings:

- Name - Select the name of your custom confirmation created in point 4 above.

- Value - Select an option from the custom confirmation values.

- TTL Seconds - Select the time in seconds for the confirmation last result to be stored in the confirmations database. Type "0" if you don't want the last confirmation result to expire. Bear in mind that each time there is a new occurrence of the confirmation it will override the previous result.

-

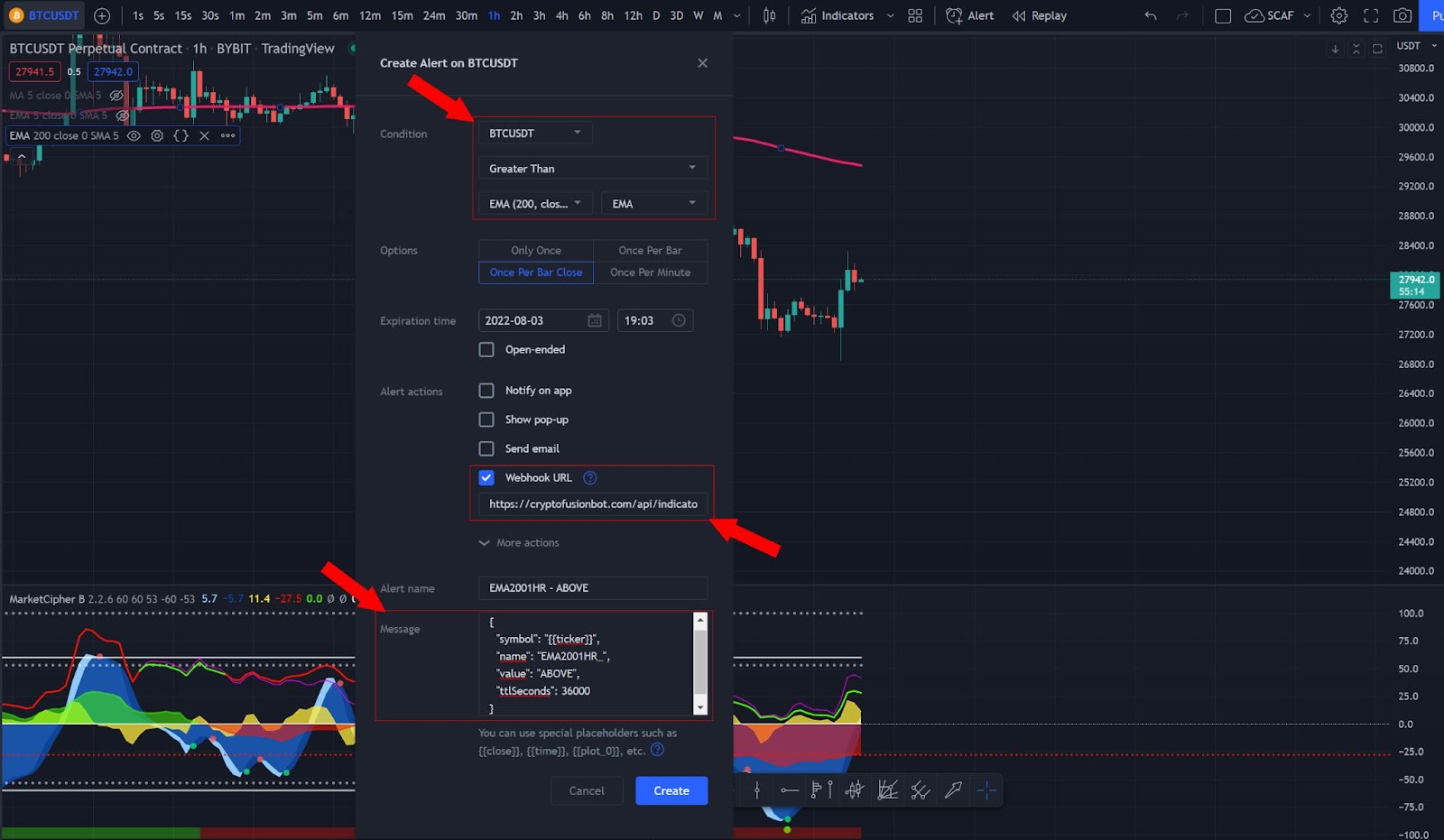

Set up an alert in TradingView. Following the example in step 1, the alert would be set up on the EMA indicator in the 1 hour time frame.

- Copy the "Webhook URL" field from step 5 into the "Webhook URL" field in the TradingView alert. Do not mix the "Webhook URL" of the "Signals" section with this one.

- Copy the "Webhook Message" field from step 5 into the "Message" field in the TradingView alert.

- Save your alert.

-

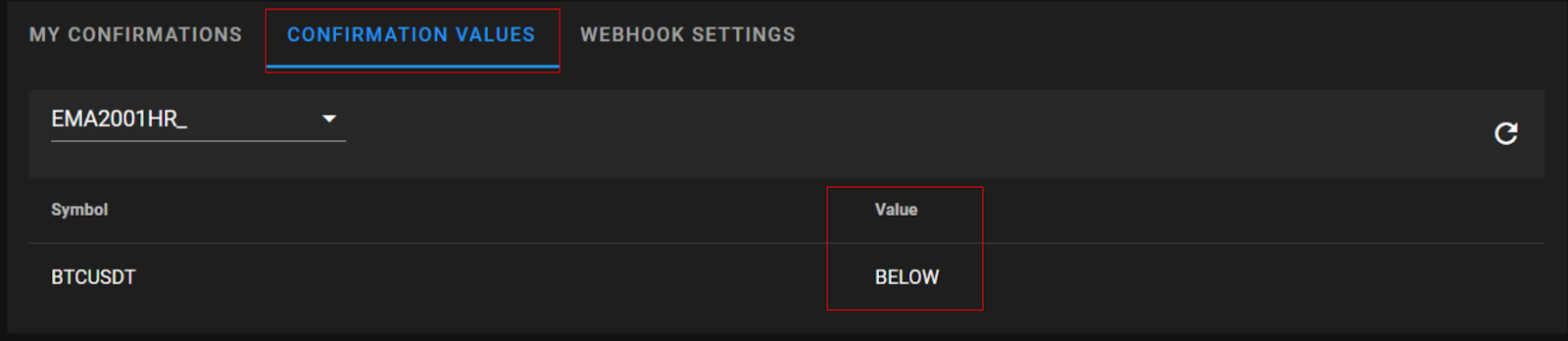

Once your alert is configured, the last status can be checked under the "Confirmation values" subsection located in the upper part side menu. Select the confirmation that you want to check in the dropdown menu, and if necessary press the refresh button to load the most up to date data.

The custom confirmation value data will be loaded for each trading pair. A value of "null" means that either the custom confirmation didn't get fire or the TTL is expired:

-

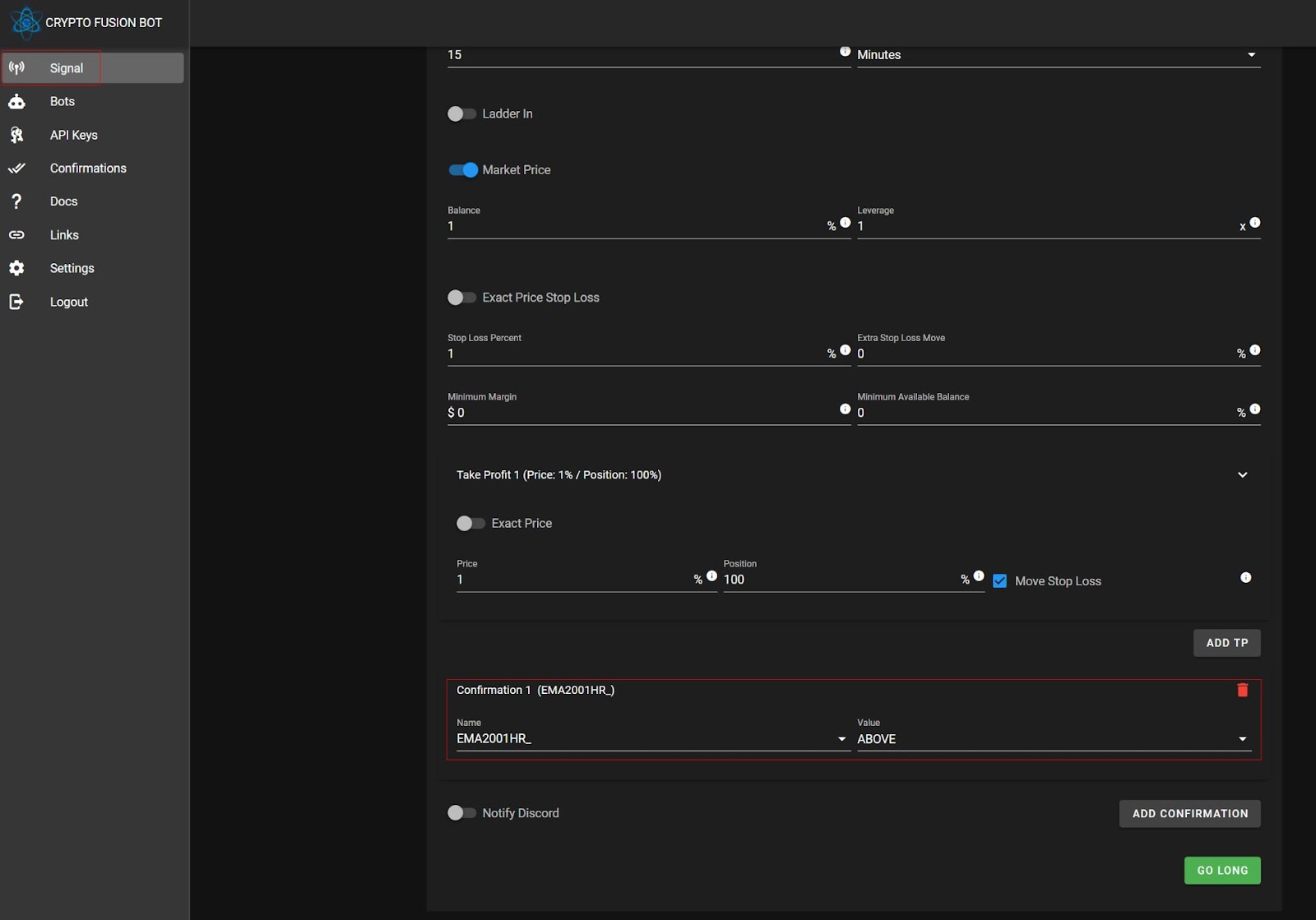

Once the custom confirmation is created it can be used when setting up a trade in the “Signals” section: